Although not widely used, this method requires an extremely detailed physical inventory. The company must know the total units of each good and what they paid for each item left at the end of the period. In other words, the company attaches the actual cost to each unit of its products. This is simple when the products are large items, such as cars or luxury technology goods, because the company must give each unit a unique identification number or tag. Cost flow assumptions are inventory costing methods in a periodic system that businesses use to calculate COGS and ending inventory.

What Is the Cost of Sales?

This system allows the company to know exactly how much inventory they have at any specific time period. Moreover, the tracking of the cost of goods sold will be more accurate if compare to periodic. The cost of goods will be the total cost of goods being sold during the month, it not the balancing figure between the beginning and ending balance. So, every time a product is purchased or sold, the perpetual system uses a barcode scanner to update the inventory count, and recalculate the corresponding cost of goods sold. Then, whenever inventory levels hit a reorder point, the software automatically generates the purchase orders necessary for restocking.

What is your current financial priority?

Regardless of the system, Rider holds one piece of inventory with a cost of $260. The decision as to whether to utilize a perpetual or periodic system is based on the added cost of the perpetual system and the difference in the information generated for use by company officials. The company’s inventory is not physically affected by the method selected. Many companies may start off with a periodic system because they don’t have enough employees to do regular inventory counts. But this can change as companies grow, which means they may end up using the perpetual inventory system when their labor pool expands.

- In fact, you will not have much information to go on should you need to track your products from beginning to end or investigate shortfalls or overages.

- The Purchases account, which is increased by debits, appears with the income statement accounts in the chart of accounts.

- In a perpetual weighted average calculation, the company keeps a running tally of the purchases, sales and unit costs.

- Let’s say you start the month with $250 in the supplies account, based on last month’s ending balance, which was based on a count of the supplies on hand and some assignment of cost to those supplies.

How confident are you in your long term financial plan?

A separate subsidiary ledger file (such as shown previously) is also established to record the quantity and cost of the specific items on hand. Under the periodic inventory system, all purchases made between physical inventory counts are recorded in a purchases account. When a physical inventory count is done, the balance in the purchases account is then shifted into the inventory account, which in turn is adjusted to match the cost of the ending inventory. Similar to purchase returns and discounts, company has to record them into the accounting system. The record will impact the accounts receivable and net off with sale revenue. The journal entry is debiting sale discount/sale return and credit accounts receivable.

Cost Flow Assumption Diagram

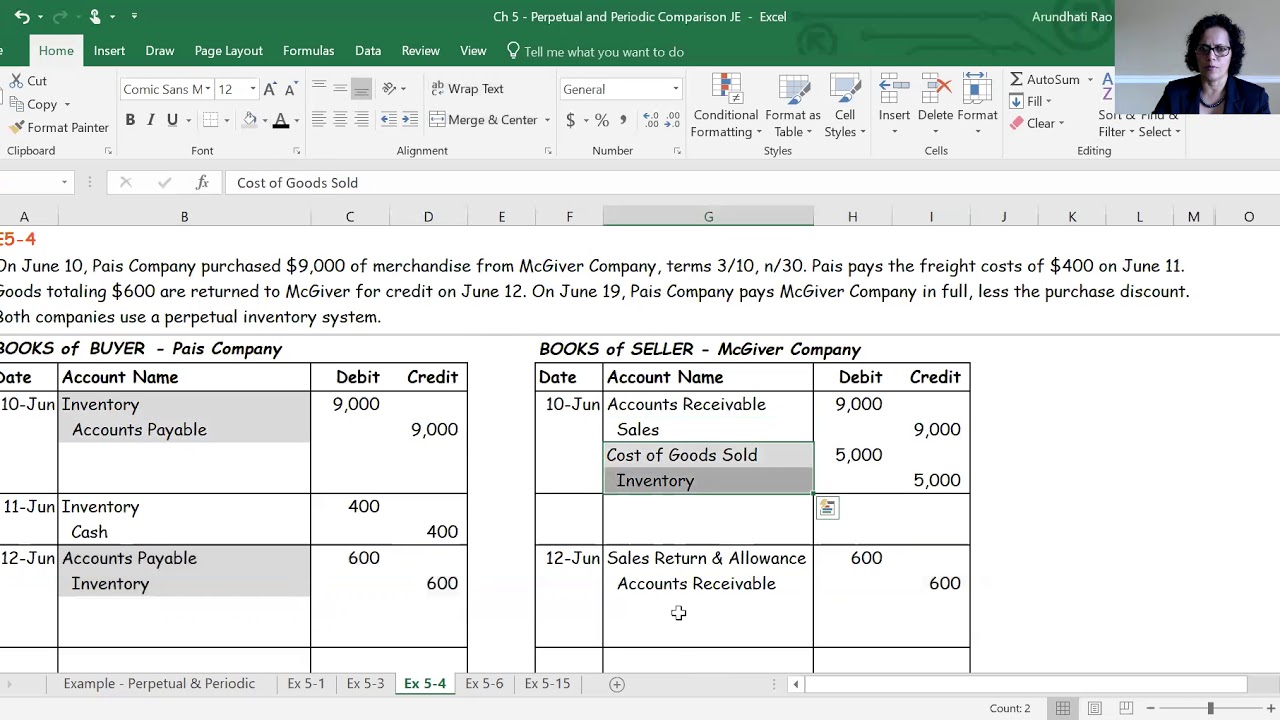

These merchandising companies often use the periodic inventory procedure. We’re going to study the periodic inventory procedure first because it’s simpler to understand. Once you get the hang of the periodic system, you just need to make some mental adjustments and think more like a computer in order to grasp the perpetual system. When the company makes sale, they have to record accounts receivable, sales discount, and sale revenue. The journal entry is debiting accounts receivable $ 9,500, sales discount $ 500, and credit sales revenue $ 10,000.

Organisations use estimates for mid-year markers, such as monthly and quarterly reports. Accountants do not update the general ledger account inventory when their company purchases goods to be resold. The accountant removes the balance to another account at the end of the year. Its journal entries for the acquisition of the Model XY-7 bicycle are as follows.

Separate subsidiary ledger accounts show the balance for each type of inventory so that company officials can know the size, cost, and composition of the merchandise. A periodic system is cheaper to operate because no attempt is made to monitor inventory balances (in total or individually) until financial statements are to be prepared. A periodic system does allow a company to control costs by keeping track of the individual inventory costs as they are incurred. Under periodic inventory procedure, the Merchandise Inventory account is updated periodically after a physical count has been made.

Companies import stock numbers into the software, perform an initial physical review of goods and then import the data into the software to reconcile. Periodic inventory is an accounting stock valuation practice that’s performed at specified intervals. Businesses physically count their products at the end of the period and use the information to balance their general ledger. Periodic inventory is normally used by small companies that don’t necessarily have the manpower to conduct regular inventory counts.

The $87.50 (the average cost at the time of the sale) is credited to Inventory and is debited to Cost of Goods Sold. The balance in the Inventory account will be $262.50 (3 books at an charitable tax deductions average cost of $87.50). LIFO means last-in, first-out, and refers to the value that businesses assign to stock when the last items they put into inventory are the first ones sold.